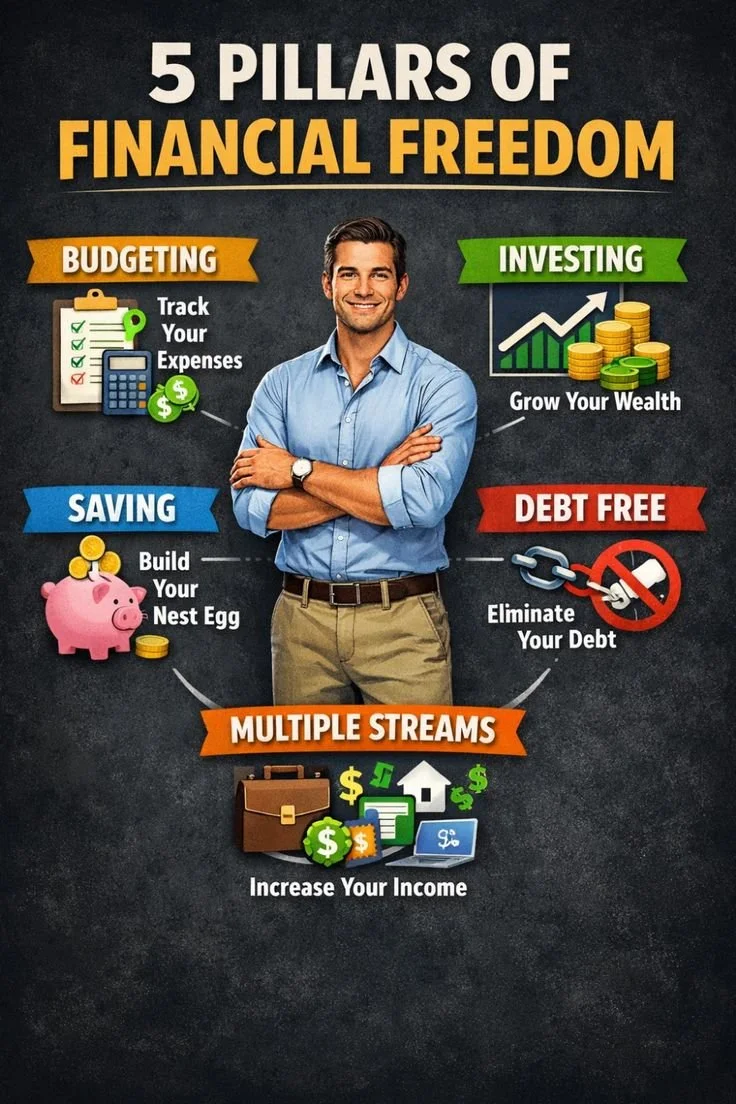

Blueprint to Freedom: 5 Steps to Wealth

Financial independence is a practical, step-by-step journey—not an overnight miracle. This guide breaks the path into five clear steps you can adopt today, pairing mindset, habits, and actionable tactics to grow your net worth and your freedom. To keep momentum, remember that physical health supports financial stamina, so integrate movement into your routine, such as targeted shoulder cable exercises to reduce burnout and maintain productivity.

Step 1 — Clarify Goals and Create a Plan

Define what financial independence means for you: a dollar figure, a lifestyle, or the freedom to choose work. Convert vague wishes into measurable goals (timeline, target passive income, withdrawal rate). Create a monthly plan that tracks progress and adjusts for life changes. Small, consistent gains compound faster than sporadic splurges.

Step 2 — Build an Emergency Fund and Cut Debt

Start with liquidity: save 3–6 months of essential expenses, then attack high-interest debt aggressively. Treat this as building your financial "core"—the foundation that keeps you steady through shocks—much like the discipline found in core-strengthening abs routines that support every athletic move.

Step 3 — Automate Savings and Invest Consistently

Set up automatic transfers to savings and investment accounts to make progress frictionless. Focus on low-cost broad-market funds, dollar-cost averaging, and tax-advantaged accounts. Use the same progressive, compound-focused mindset you’d apply in the gym—similar principles guide gains in finance and fitness—think of your strategy like triceps-building exercises that add strength through steady, incremental overload.

Step 4 — Increase Income and Protect Gains

Seek ways to grow income: negotiate raises, build side projects, or invest in skills that increase your market value. Protect your wealth with proper insurance, a basic estate plan, and a tax-aware investment strategy. Prioritize scalable income sources (business, royalties, dividend portfolios) that move you closer to passive-income targets.

Step 5 — Maintain Lifestyle Discipline and Reinvest

As income grows, resist lifestyle inflation. Reinvest surpluses into assets that align with your independence goals. Keep energy and focus high—habits that sustain performance are as important as balance sheets; mentally and physically fueling your days is essential, akin to adopting continuous fueling strategies that support long-term output.

Conclusion

For a complementary perspective on the psychological habits that support lasting financial freedom, see The Mental Wealth Blueprint: 5 Steps To Psychological Freedom.